The role of investors in shaping a sustainable circular economy

Investment

Investors and financial markets have a pivotal role in the transition to a circular economy. By redirecting investments towards circular projects and businesses, we can unlock significant economic opportunities while reducing environmental impact” – Achim Steiner, Administrator of the United Nations Development Programme (UNDP)

As discussed in our previous blogs, transitioning from a linear to a circular economy is essential for sustainable economic growth, climate change mitigation, environmental impact reduction, and social equity improvement. Investors, alongside other key stakeholders such as governments and NGOs, are pivotal in facilitating this transition.

At Isio, we believe that investors can maximise their financial power and strategic influence by focusing on education, engagement, and collaboration. This blog aims to delve into these actions as tools available to investors to help drive the transition towards a circular economy

Educate

Investors should prioritise understanding the risks and opportunities associated with linear economic models and the shift towards circular economies. This knowledge is crucial due to the potential impacts on financial outcomes and fiduciary duties. Our blog series serves as a starting learning point, outlining some of the key risks—such as resource scarcity, supply chain disruptions, and price volatility—as well as the opportunities presented by circular approaches. However, to maximise effectiveness, investors are encouraged to delve deeper into the most relevant issues for their specific mandates and portfolios, tailoring their learning agenda accordingly.

- Understanding the impacts on stated ESG priorities: As explored in our blog series, there are expected impacts that span across climate, nature, and social issues. Different investors have different ESG priorities, for example a focus on Net Zero or on specific UN Sustainable Development Goals. Each of these priorities intersect with circular economy considerations. As such, investors may want to further educate themselves on how their existing priorities may be affected by linear and circular practices respectively.

- Learning about the risks and opportunities in sectors with significant capital allocation: Investors may want to prioritise learning about the linear issues and emerging circular solutions related to the sectors they have significant exposure to. The table below provides some examples in line with the case studies explored in our blog series.

Renewables

Investors with exposure to renewable energy infrastructure may want to deepen their understanding of sector challenges, including natural resource depletion, labour issues in supply chains, recycling difficulties for components like blades and solar modules, and biodiversity impacts from landfill waste disposal and infrastructure locations.

Plastics

Investors with exposure to single use plastic sectors – e.g., food and beverage, retail, pharma – may want to start by educating themselves on the environmental and health impacts of these sectors, upcoming regulations, and potential benefits of investing in bioplastics and recycling technologies.

Fast Fashion

Investors with exposure to the textile and fast fashion industries may want to prioritise learning about sustainable materials and recycling programs, sustainable fabrics, and recycling initiatives.

On the back of this learning effort, investors may want to consider elevating the focus on circular economy in their sustainability and ESG discussions. While it may not become the top priority given the range of ESG issues requiring attention, the expanding recognition of the circular economy’s broad impact across sectors and ESG issues warrants increased attention. Setting explicit targets around the circular economy will however be challenging, especially given data challenges. It may however be worth investors exploring the possibility of setting targets, for instance, an investor aiming to support the 30×30 biodiversity goal, which seeks to protect 30% of the planet’s land and oceans by 2030, could explore setting an interim circular economy target to reduce plastic waste by 50% in invested companies within the next five years. As transparency and data improves around this topic, this could be an area for investors to increasingly focus on.

Engage

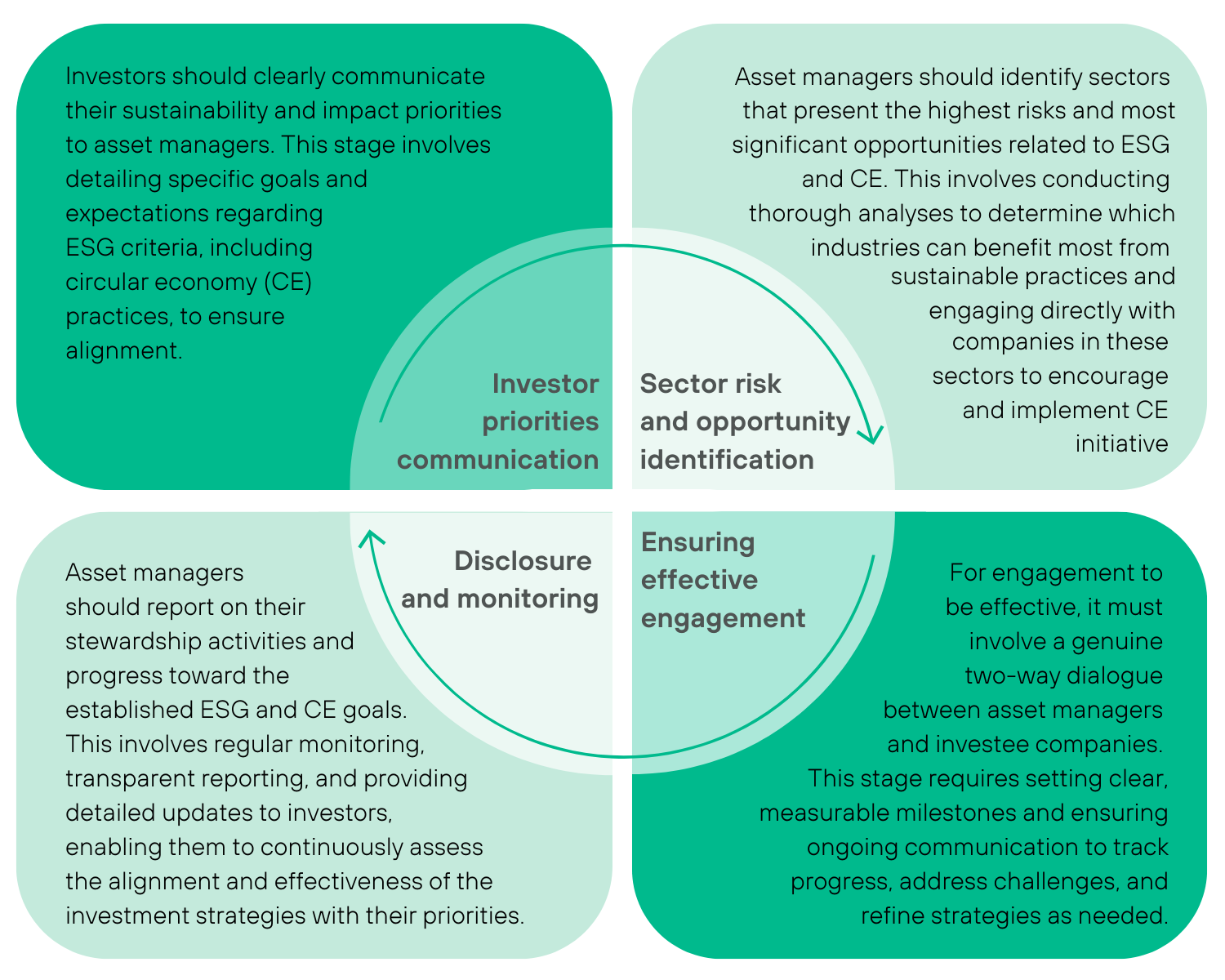

Investors should place greater emphasis on engaging on circular economy issues. Effective engagement is essential for aligning priorities throughout the investment value chain, encompassing asset owners, asset managers, and investee companies. Beyond improved education, engagement serves as an operational tool to ensure that these considerations are reflected, discussed, and monitored across the investment lifecycle. Engagement with investee companies (typically via asset managers) can play an important role across several key stages:

Collaborate

Investors should consider exploring the growing array of circular economy collaboration initiatives. Collaboration holds the potential of facilitating the pooling of resources, knowledge, and expertise, accelerating the implementation of circular economy solutions. There are currently limited investor-specific initiatives specifically focused on the circular economy and we hope that existing broader initiatives will increasingly focus on circular economy challenges. The multi-faceted nature of the circular economy challenge calls for a unified approach across different players, as such, multi-stakeholder collaborations are particularly effective in translating goals into real-world impacts and ensuring alignment among diverse economic actors, such as governments, NGOs, consumers, and investors. The CE100 Network and PACE are two prominent examples of global, cross-stakeholder initiatives that seek to advance the international circular economy agenda.

There are also a range of sector-specific initiatives that we hope to see asset managers and asset owners increasingly engage with. The table below provides some examples in line with the case studies explored in our blog series.

Renewables

The Global Battery Alliance (GBA) is a public-private initiative launched by the World Economic Forum to promote the sustainable and responsible production, use, and disposal of batteries crucial for renewable energy technologies like electric vehicles and energy storage systems.

Plastics

Founded in 2019, the Alliance to End Plastic Waste is a global initiative which includes companies from across the plastics value chain, along with governments, investors, and NGOs. It aims to develop and deploy solutions to minimise and manage plastic waste.

Fast Fashion

Fashion for Good is a multi-stakeholder initiative that supports startups that promote circular and sustainable fashion through their innovation hub, accelerator programs, and knowledge-sharing initiatives.

Conclusion

Our blog series has explored the importance of shifting from a linear to a circular economy and the crucial role investors play in this transition. We believe that investors’ involvement is critical not only for achieving sustainability goals but also for potentially optimising returns and fulfilling fiduciary responsibilities. Linear economic models are increasingly linked to significant climate, nature, and social risks, whereas circular economy approaches present opportunities for early mover advantages and better alignment with evolving consumer preferences.

In this final blog, we have provided a toolkit designed to assist investors in navigating this transition. While immediate implementation of all tools may not be necessary, these steps are instrumental in advancing the finance industry towards a circular economy.

As we wrap up this series, we want to emphasise our continued commitment to supporting our clients in overcoming these challenges and effectively leveraging their investment power for optimal outcomes.

Insight

Our blog series

This is our final blog in our circular economy series, where we seek to raise awareness on the topic and consider potential investor action.

Get in touch

Cadi Thomas

Cadi Thomas

Head of Sustainable Investment

Mark Irish

Mark Irish

Deputy Head of Sustainable Investment Consulting

Get in touch

Talk to us today to see how our bolder thinking can get you better results.